Intel‘s (INTC -1.49%) stock price has been seeing some big swings over the last year as investors weighed the benefit of emerging opportunities against various geopolitical pressures and other risk factors. One analyst firm weighed those conflicting actors and came away with the assumption that the semiconductor giant’s share price is heading significantly higher in the near term.

In a research note published on April 1, UBS‘ analysts maintained a neutral rating on Intel but raised its price target on the stock from $46 per share to $50 per share. With the stock currently trading at roughly $44 per share, that would imply a potential upside of nearly 14% over the next 12 months or so.

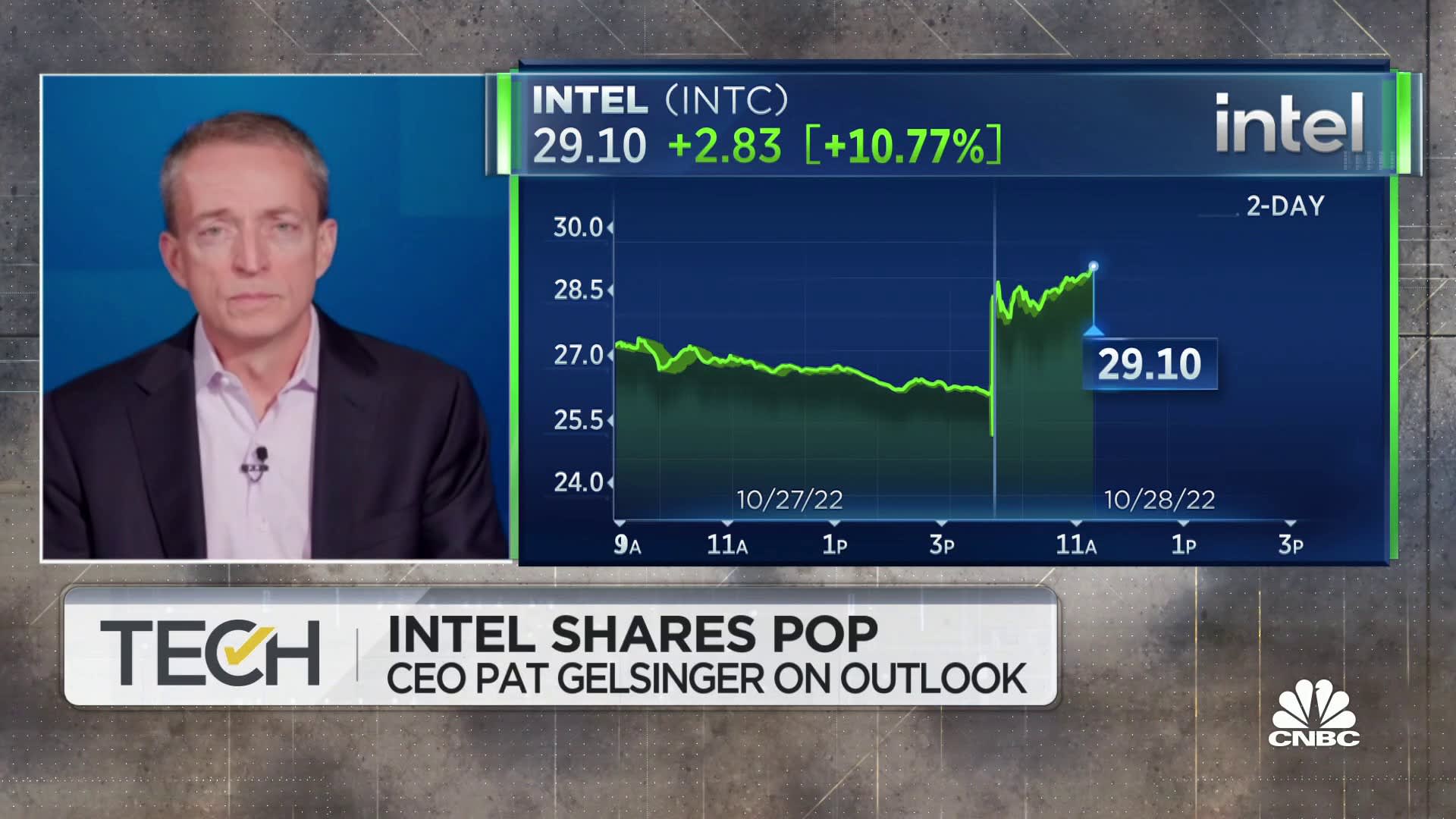

go to link :- https://www.intc.com/stock-info/charts

Intel has some promising opportunities ahead

Intel’s core business of designing central processing units (CPUs) for computers and servers has been showing some signs of weakness in recent years. The company has been losing ground to Advanced Micro Devices in PCs and servers, and the business also faces competitive pressures from Arm Holdings. But Intel also has some intriguing growth opportunities on the horizon.

Intel is making a much bigger push into the chip fabrication market and intends to generate much more business from manufacturing chips designed by other companies. UBS’s analysts see significant promise with the initiative, but they remain somewhat cautious about Intel stock due to concerns that the chip company is behind when it comes to artificial intelligence (AI) and other key growth segments.

Ultimately, I think Intel stock stands out as a worthwhile buy right now. While it’s somewhat difficult to get a read on the company’s positioning in the AI race at the moment, the chip giant’s opportunities as a fabrication services provider still appear to be underappreciated. For long-term investors, I think building a position in Intel at today’s prices would be a smart move.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $545,088!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.